Today, I’m going to tell you about four insurance companies that have gone bankrupt and what happened. More importantly, we will tell you everything you need to know about the insurance market and how to prepare yourself. Let’s dive in!

Over the last several years, we’ve had some devastating storms that have come through that have just decimated our states and have made it impossible for some insurance companies to stay in business. I’m going to break that down for you and give you a little bit of an understanding of the mechanics of insurance and how an insurance company works.

4 (now 5, as of June of 2022) insurance companies have gone bankrupt, and several others have stopped writing new business in Louisiana. Then there are others that have just said, we’ve got to leave the state because if we stay there any longer, it will affect our national ranking, and our national solvency may potentially put us bankrupt nationally. So they have had to leave the state completely.

Kemper no longer writing in insurance in Louisiana

One of those companies is Kemper. They’re a national market, but they’ve had to leave because of just so much devastating claim damage from the hurricane-affected states, such as Louisiana, Mississippi, and Flordia.

I know many people just think insurance companies are massive businesses with lots and lots of money to pay claims, right? Well, they do in a sense, but the way it works is whenever an insurance company comes to a state, they want to write insurance. Now I’m gonna make this just real simple because it can be complex and boring. And frankly, you probably don’t really care. Basically, they come into the state, and the Department of Insurance says you’ve got to have at least this much money on hand as a reserve so that you can pay claims. Another thing that they’ll say is that you can also buy reinsurance to help with that. And they will say if you’ve got this many clients, this much-written premium, you’ve got to have this much insurance, it’s kind of it’s a little bit of algebra in there, but we’re not gonna get into that. They don’t have a limitless money supply. They got reserves, and then also they have reinsurance. If both of those are depleted, they become bankrupt. We had 4 insurance companies that this has happened to in the last 8 or 9 months. One of those is an Access Home Insurance Company.

Access Home Insurance Co

They were a great company, but they just were decimated by the amount of storm damage that occurred to their clients that they had to pay out. They had $30 million worth of premium inside of the state of Louisiana. Inside those three years, 2021 to 2022, they had $180 million worth of claim damage That’s several times over how much premium they had collected. Well, they had $115 million of reserves or reinsurance combined to take care of those claims. If you did the math, they’re $65M in the hole, so they had to go bankrupt.

State National Fire

Another insurance company that went bankrupt was State National Fire. They wrote $3 million worth of insurance inside of the state of Louisiana. They had $70 million worth of claims in that time period. Seventy. Million.

Now you almost wonder how is that even possible? Well, they only had $41 million worth of reserves and reinsurance. So they are $26 million short. They went bankrupt. Other companies, Lighthouse Insurance Co, many of you know who they are, and you may have even had insurance with them, had over $20 million dollars worth of premiums inside the states of Mississippi, Louisiana, and Texas. They also were decimated by claims and just recently became insolvent. Gulf Stream Insurance Co

The last company they’re gonna talk about is Gulf Stream insurance company. They had 20,000 clients in the states of Mississippi, Texas, and Louisiana. And they, too, were just decimated by these storms. They were actually one of the first ones that went down among these four different insurance companies. Over 60,000 households were affected, meaning they lost their insurance because of what happened in that period.

What exactly happened during that period? And, what type of money are we talking about on claim damage? Are we talking about combined? Let’s take a look, and let’s break down some of the data about what has happened that has led us into this position where we have four different insurance companies that have gone bankrupt in the state of Mississippi, Louisiana, and also Texas would provide homeowner insurance for those states. Let’s also take a look at what this has caused insurance companies that say we’re not going to issue any new clients this year, the rest of this year, and others that have said we’re done in those states we’re leaving.

So I’ll give you a number here… get ready for this. Over the year 2020 to 2021, there were 3 large storms and 3 hurricanes that caused a significant amount of damage. I’ll talk to you about those three storms in a minute, but they caused $10.6 billion worth of damage over that period.

Hurricane Laura

The first one was Hurricane Laura, it was in August 2020. It affected Lake Charles, but really, it affected the majority of the state as well. It caused $9.1 billion (yes, Billion, with a B!) worth of damage in that storm alone! 3/4 of Louisiana was without power. And I mean, no power at all. There were tree limbs over highways, four-lane highways, two-lane highways, and many other roads that you could not even drive because they were either covered by water or covered by debris from the wind. Power lines were down everywhere, in yards and over highways. There were interstates, actual four-lane interstates, that were closed off because of the amount of damage and debris. It was almost impossible to find a gas station that still had gas because almost everything was without power. And then there was also no distribution to get the fuel in those areas. They even got power companies to get in to start restoring power to get gas stations back online, as well as grocery stores, restaurants, etc.

Hurricane Delta

Hurricane Delta hit in October of 2020 and it caused $875 million worth of damage. The biggest storm that ever hit Louisiana was, or the most damaging, I should say, was hurricane Katrina. The second was Hurricane Rita, and it was also were really close period of time. Hurricane Rita was the number two most damaging storm of all time for the state of Louisiana until hurricane Laura, and it easily surpassed the amount of damage that was done by the hurricane. Hurricane Ida happened in September of 2021, and causeed $72.25 billion worth of damage. Yes, you heard me right $72 billion worth of damage in the state of Louisiana, Texas, and Mississippi.

There are areas of South Louisiana that are still trying to recover that are in massive amounts of debris that there’s not enough manpower to get to, to be able to fix yet. You know, on top of that, we also had the February Freeze.

February Freeze (Ice Storm of 2021)

Remember that in 2021, the storm affected the state of Texas and Louisiana greatly. For a solid week, it rendered a lot of damage in the state of Texas and Louisiana where you could not do anything because it was just under a complete freeze that the roads were frozen over solid. We had tons of claims like ice dams and other things. Buildings collapsed because of the weight of ice and snow. That was another $20 billion worth of damage. On top of that, it was 172 people that lost their lives between those two storms. This last year, it was just more than several of these different insurance companies could take.

What’s the effect of this? What does this mean to you and me?

The reality is, insurance companies just don’t have a limitless budget. Sometimes you get to the point where it’s just you never can imagine that you’d have that sort of a devastating series of years back to back. It was just too much. So what’s happening to us? Well, as I mentioned at the beginning, we’ve had four insurance companies that provide homeowner insurance for people that are affected by 60,000 families. They’re just gone… they just could not sustain that. So now they’re gone. Also, on top of that, we’ve had several insurance companies that have just had to leave the state, because they just could not make money anymore, it is affecting their national profit, profit margin so that they just could not continue to sustain it because they would have had just another year that has been anything where in the remotely in that vicinity of claim damage, it would have made them insolvent nationally, and that would affect it the entire United States, or at least large sections of our country. Also that has led to several insurance companies just having to say, hey, look, we just we’ve got to stop, we’re gonna hang on to what we’ve got. We can’t take any more clients on, but we’re committed to at least staying here. But we just got to stop, we get it, we got to wait, let’s see, let this year go by and see what happens. And they’re just hoping that through this hurricane season, which we’re about to enter, it will not affect them. So that will make them become insolvent also, or have to leave the state. So what are some other things that are gonna affect you or me? Well, one is, you know, it’s becoming more scarce to find homeowners insurance company, you know, especially if you live in coastal areas of those states, you’re finding out that a lot of insurance companies are canceling, they’re just, you know, non renew, and you because of the things that we’ve talked about.

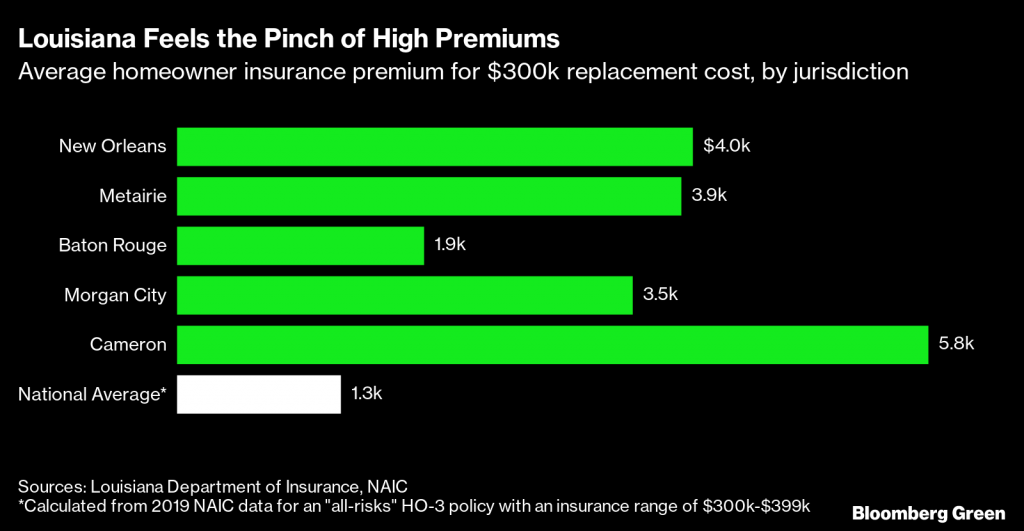

Massive Rate Increases

Another thing is that you’re seeing massive rate increases, right? You see double-digit rate increases to your homeowner insurance company, and you’re trying to look for other options and you finding, there’s not really any better options, because it’s affecting everybody. You know, what are some other things? Well, you’re finding also that a lot of insurance companies are doing things like maybe excluding wind and hail, and you have to go through, you know, one of the citizen’s companies or some other third party company to pick up wind coverage, and also health coverage, or those deductibles are being increased, because the insurance companies are just having to, they just can’t continue to sustain it. You know, these are a lot of different things you’re seeing and what we’re entering into, or what we have entered into is what I should say, here’s what we call a hard market, you may have heard insurance, talking about a hard market before what a hard market means is just that you’ve got, it’s well, I guess, I guess you could just say that it’s, it’s really hard to find insurance, for a certain thing. In this case, it’s homeowner insurance is very hard to find inexpensive homeowner insurance because of the state of the market. And insurance companies are going to have really, you know, a lot of increases on their rates, and it’s going to become harder, but you know, understand that it’s not just us affecting everybody. And you know, this big pool is how insurance works. And it’s just it’s going to affect all of us, unfortunately. And hopefully, we can have a couple of good years in these states and insurance companies recover, but just know for a little while, it’s gonna be a little tough with your homeowner insurance company.

Find out what is different about us today:

Text or call: 318-336-5202

Email reed@reedinsla.com

You can meet our team HERE

You can start a quote HERE

We’ll be glad to take a look at your insurance coverage in any of the states of Louisiana, Texas, Arkansas, and Mississippi.

Thank you,

Beaux Pilgrim, CEO

Beaux Pilgrim

Reed Insurance