In the previous article, we discussed Physical Damage coverage, also knows as Comprehensive and Collision Insurance on your auto insurance policy, this is the part of your policy that pays to fix your car for things like: glass breakage, tree damage, hail, fire, and other things.

This article will talk about Uninsured and Underinsured Motorist Insurance.

CLICK HERE for Personal Auto Liability

Uninsured and Underinsured Motorist Coverage is a part of the policy that provides medical expenses for you, a member of your family, or a designated driver if one of you is hit by an uninsured or hit-and-run driver.

For this article, I am going to refer to both as Underinsured Motorist coverage, but make sure you understand:

- Uninsured Motorist Coverage will apply when the at-fault driver has NO insurance.

- Underinsured Motorist Coverage will apply when the at-fault driver does not have ENOUGH liability insurance

- Both are usually sold as a pair

CLICK HERE for an overview of the auto policy

Uninsured Motorist Insurance is sold to answer two common problems regardless of the state you live in.

Problem # 1 is many people are driving the roads and highways with you and have NO Auto Liability insurance at all.

You may ask, “how can that be? We have laws that say you have to have insurance!”

Yes, we do have laws that state that you must have auto liability insurance to own and operate an automobile. Regardless many people break the law every day, and you potentially could pay for their disregard for the law if you are involved in an accident with one of them.

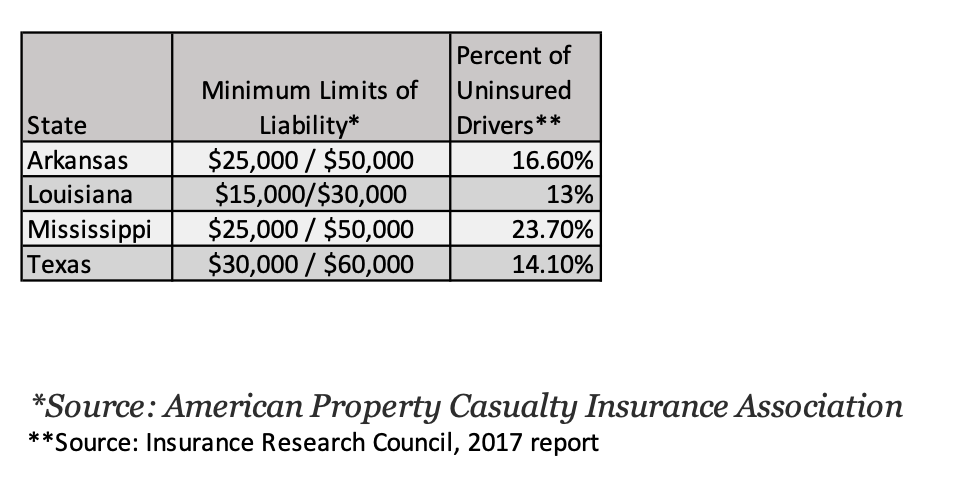

Here is a chart that shows the percentage of drivers without insurance.

Problem # 2 many drivers do not have enough insurance.

Refer to the chart above, and you will see the state minimum auto liability limits. These are the auto liability limits that the state requires at a minimum for each driver.

Here is the problem, those limits are not enough!

Those numbers represent the following:

The first number = How much the policy will pay for medical expenses per person.

The second number = How much the policy will pay for medical expenses per accident.

Those minimum limits will not go very far if you are moderately much less seriously injured in an auto accident. Remember, we are talking about an accident that is someone else’s fault that should be paying for what they did.

“What about my health insurance? Would it pay?”

The answer to this question is yes. However, you do have deductible and co-payments and other limitations in coverage that may not provide for all of the medical and rehabilitation needs that you or one of your loved ones may need.

I hope this helps some. Please check out the other videos in this series by going to our website and check out our Video Eduction Series, where you can find other videos and a link to the articles.

Here at Reed Insurance, we have 4 goals:

- Provide products and services focused on protecting our clients’ assets and financial well-being.

- Ensure that our clients understand the products and services they are buying.

- Pair our clients with products that fit their security and financial needs.

- Use our access to many insurance companies to keep these promises.

The important thing is that you discuss these options with your independent insurance agent and make sure you have an independent insurance agent who will educate you regarding your options.

Find out what is different about us today:

Text or call: 318-336-5202

Email reed@reedinsla.com

You can meet our team HERE

You can start a quote HERE

We’ll be glad to take a look at your insurance coverage in any of the states of Louisiana, Texas, Arkansas, and Mississippi.

Thank you,

Beaux Pilgrim, CEO

Beaux Pilgrim

Reed Insurance